Academic pharmacist Nataly Martini highlights the importance of understanding non-Hodgkin lymphoma and pharmacists’ roles in managing this condition

Room for optimism in another rollercoaster year

Room for optimism in another rollercoaster year

Signs are pointing to strong sales this year for cough and cold medications but sharply rising inflation could yet muddy the waters. Libby Woodhouse, senior account manager for IRI, discusses latest sales data

There’s no question the retail sector has experienced a roller coaster in fortunes over the past two years, and while this seems set to continue in 2022, research shows Kiwis are increasingly viewing pharmacies as trusted partners through the pandemic.

At IRI we have crunched the numbers to establish the impact of COVID-19 on the pharmacy sector and identify emerging trends for the coming months.

The figures suggest the recent surge in demand for self-monitoring devices will continue, as will the popularity of natural health supplements for those seeking a more holistic approach to wellbeing. As well as stocking up on cold and flu products, Kiwi consumers are tipped to be adding a few luxuries to their shopping baskets this year.

Oximeters feature on many COVID kit lists, prompting a sales increase of more than 2000 per cent

The emergence of the Omicron variant of COVID-19 this year brought with it a government recommendation for Kiwi households to prepare for an outbreak. The entreaty to maintain a stock of medicines to manage symptoms at home led to a marked rise in demand for painkillers and cold medicines, alongside the masks and hand sanitisers that have become shoppinglist staples.

With pharmacies viewed as an accessible and expert source of healthcare advice, consumers have turned to the channel for help in choosing devices to monitor health. Oximeters, which previously had small but steady sales, feature on many COVID kit lists, prompting a sales increase of more than 2000 per cent, to be valued at $1.02 million in the latest quarter1. There has also been elevated demand for thermometers, another recommended tool for assessing COVID symptoms.

A by-product of social distancing and greater hygiene measures has been a significant reduction in instances of influenza and flu-like illness. There was a 28 per cent drop in cough/cold goods in 20201, and only a modest recovery last year, with products targeting symptoms particularly hard hit.

However, this could be turned on its head in the coming months, as with the re-opening of borders and the easing of restrictions, epidemiologists are predicting a difficult cold and flu season in 2022 – which will likely herald a rise in shoppers through pharmacy doors.

One segment we have seen a rise in across overseas markets are preventive cold and flu products, such as nasal sprays, intended to be used at the first signs of illness. With New Zealanders now having a heightened awareness of first symptoms, a similar trend is expected here.

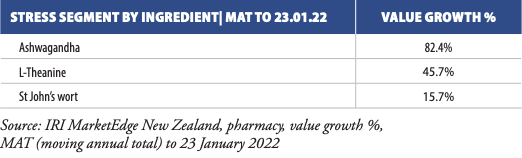

The havoc of the past two years has undoubtably brought higher levels of stress. According to the IRI State of the Industry Household Shopper Survey, 45 per cent of Kiwis are trying to minimise stress to support their immunity, and many are taking a holistic approach to doing so. While activities such as exercise and mindfulness play a role, consumers are also turning to natural health supplements.

Ashwagandha, the latest trending herb for stress, has seen growth of 82.4 per cent over the past year1, with eight new Ashwagandha products launched in the past 24 months. The search for supplements to support stress has also had an impact on well-established ingredients, such as St John’s wort, which saw an annual value increase of 15.7 per cent.

Adequate sleep is a widely accepted tool for managing mental wellbeing and immunity, yet only 50 per cent of Kiwis surveyed by IRI are making that connection and getting the recommended seven to eight hours of shut eye per night to support their immunity. One in three believes their sleep has worsened in the pandemic.2

As with stress, this has made natural health a destination for shoppers, who have particularly sought supplements with herbal ingredients. Kiwis have also endeavoured to create a better sleep environment, with a 42 per cent growth in eye masks2, and strengthening sales of lavender oil, known for its calming and sleep-supporting benefits.

This year has already established itself as a year of inflation and there are no signs of it slowing. Seen everywhere from the price at the petrol pump to mortgage rates, inflation is at a 30-year high.3

As the cost of living increases, so buying power erodes, and over the coming months we are likely to see Kiwis tightening their belts and seeking value. Online shopping has become widely used for product and pricing research before purchase, a trend IRI expects to continue.

However, it’s not all about the bargain hunt. Past periods of high inflation have led to the “lipstick effect”, where instead of spending money on big-ticket items, shoppers turn to small luxuries, such as designer-brand lipstick.

Both prestige-brand lipstick and fragrance had strong Christmas sales, potentially a signal this trend is re-emerging. Although continued restrictions and working from home are likely to slow demand for cosmetics, this will be a category to watch in the second half of the year.

As with so many aspects of the outlook for 2022, inflation is a challenge that brings with it opportunity, and over the coming months pharmacy will continue to play an important role for Kiwis. By adding value through expertise and advice as well as providing consumers with those small but affordable luxuries, there are pockets of growth open to explore.

IRI is a global data analytics and insights company working mainly within the FMCG (fast-moving consumer goods) environment

- IRi MarketEdge, New Zealand, Pharmacy (Green Cross Health + Independent Pharmacy) MAT to 23/01/22

- IRi State of the Industry Household Shopper Survey Oct 2021, N=1000, Powered by Dynata

- Stats NZ, Annual inflation hits a three-decade high at 5.9 percent, 27 January 2022